Short Stock Explained

Its mostly done by hedge funds and other professional investors. Retail and Institutional investors are permitted to short sell.

Short Selling Stocks Explained New Trader U

Short Selling Stocks Explained New Trader U

Short Selling Stocks Explained.

Short stock explained. Shorting a stock also known as short selling is one way to potentially profit from a downward move. Short selling means betting against a stock the process involves several transactions lets take a look. Suppose you believe the stock price of ABC is grossly overvalued and the stocks going to crash.

Both options must be in the same expiration cycle. Short selling is an investment or trading strategy that speculates on the decline in a stock or other securitys price. Traders often say I am going short or go short to indicate their interest in shorting a particular asset trying to sell what they dont have.

Short sellers take on these transactions because they believe a stocks price is headed. When you short a. George Soros for example.

Short selling is a fairly common feature of markets. It is also done to mitigate losses from a declining stock in your portfolio. The synthetic short stock options strategy consists of simultaneously selling a call option and buying the same number of put options at the same strike price.

Short selling with leverage is a technique that many traders use to make a quick buck amplifying a small amount of capital in the hope of amplifying their gains. As the strategys name suggests a synthetic short stock position replicates shorting 100 shares of stock. The term short often is used to describe an open position as in I am short SPY which indicates the trader currently has a short position in SP 500 SPY ETF.

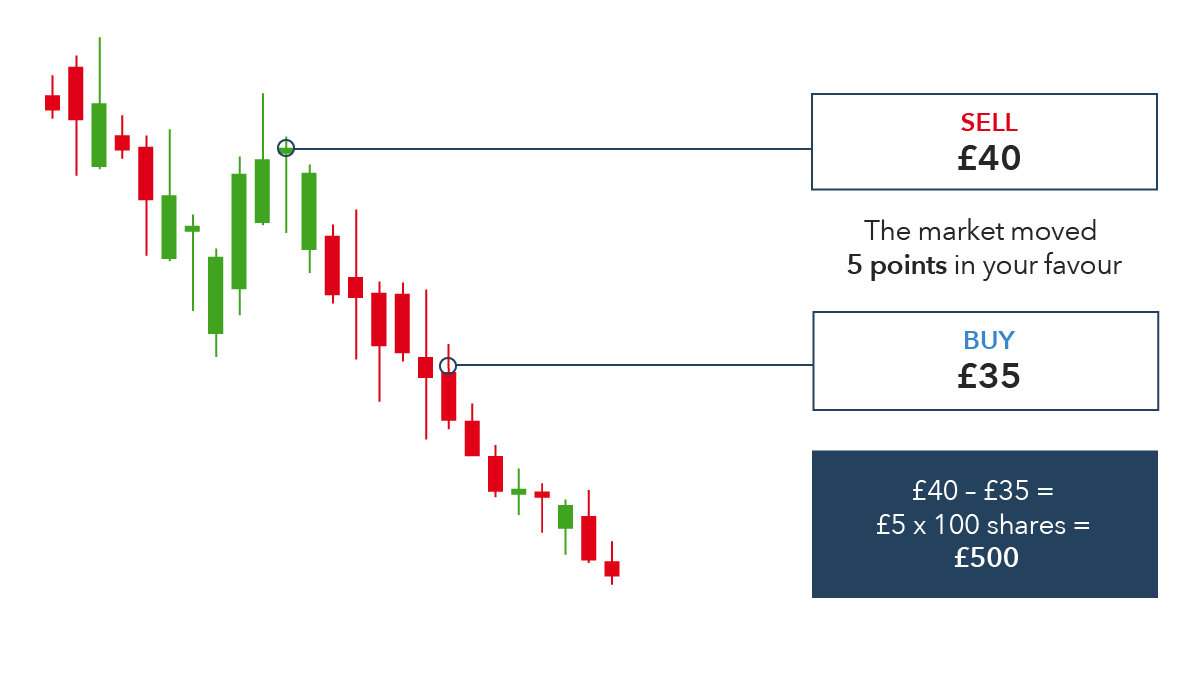

Shorting stock is the opposite of buying stock and is a concept that can be hard to grasp. Short selling is a fairly simple conceptan investor borrows a stock sells the stock and then buys the stock back to return it to the lender. You capture the money from the sale.

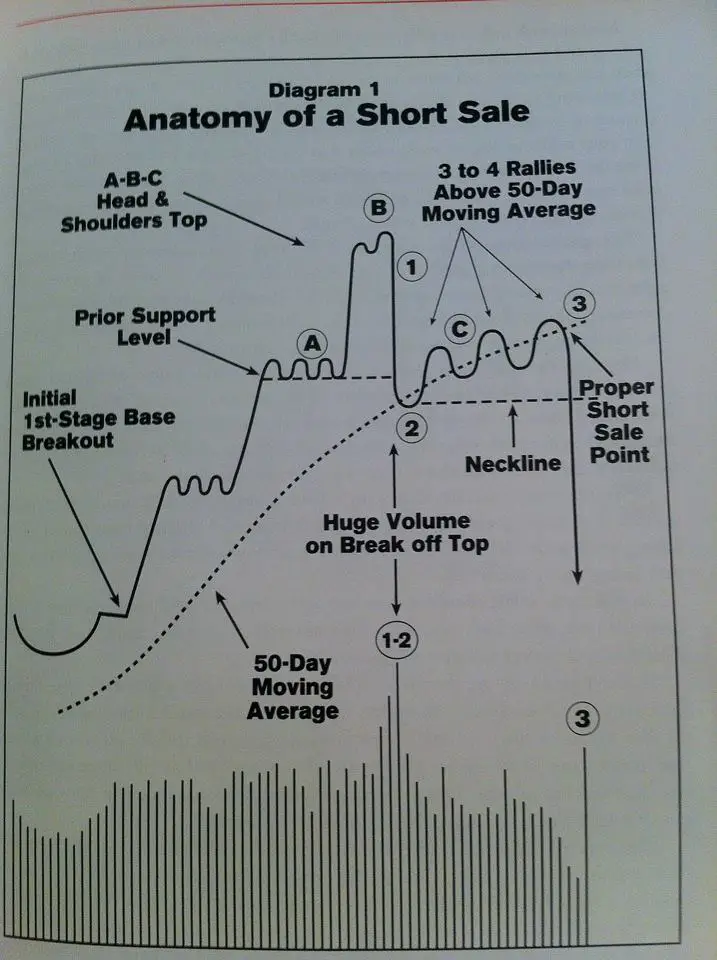

Some short-sale trades have entered market lore. Shorting a stock is statistically speaking potentially more profitable during a down market. If you want short selling explained heres an example of it in action.

The Basics of Shorting Stock Motivation to Sell Short. Getting ahold of the shares you want to short since you do not own them youre forced to put margin as collateral for the transaction thats why short selling always happens on margin trading. Shorting stock enables you to make money when the market is going down and when companies are failing meaning that even when the economy is.

When you analyze a stock and realize it could be due for a fall you would consider short selling the name. William has been eyeing up the stock. Short-selling a stock gives investors the option to make money in environments where it has become harder to do so.

What Is Short Selling. Also known as shorting a stock short selling is designed to give you a profit if the share price of the stock you choose to short goes down -- but can also lose money for you if the stock price. It is an advanced strategy that should only be.

Selling shares of the company without having their ownership. In the stock market parlance short selling would simply mean the selling of shares of the company before buying them ie. However you need to start the shorting process by borrowing shares from your brokerage firm to sell on the open market.

What is Short Selling If you have been investing longer than a week no doubt you have already heard of the terms bull and bear long and short. The aim is to sell high and buy low. Beware of the Risks.

Short sellers are betting that the stock they sell. Read on to learn more details including. If the stock falls in price you would have unrealized profits.

This strategy is popular among savvy risk-tolerant investors who may have a knack for market research and predicting trends. They give you a plethora of tools and resources to research stocks so you can quickly find an undervalued stock to short. Most people that have turned on the news already know that a bull market is one that is rising and a.

What Is Short Selling Is It Good Or Bad Yadnya Investment Academy

What Is Short Selling Is It Good Or Bad Yadnya Investment Academy

How Short Selling Works Thestreet

How Short Selling Works Thestreet

Why Must The Short Seller Pay The Dividend On A Stock Sold Short Quora

Stock Market Forex What Is Naked Short Selling And Is It Really Bad As Thay Say

Stock Market Forex What Is Naked Short Selling And Is It Really Bad As Thay Say

Short Interest Consensus Nobody Wants To Bet Against Stocks Sage Investors

Short Interest Consensus Nobody Wants To Bet Against Stocks Sage Investors

What Is Short Selling The Complete Guide To Shorting Stocks

Short Selling Stocks A Short Selling Example Firstrade

Short Selling Stocks A Short Selling Example Firstrade

Selling Short Easy Explained With An Example Youtube

Selling Short Easy Explained With An Example Youtube

Understanding Short Selling Youtube

Understanding Short Selling Youtube

How Do You Short A Stock Learn With Examples Ig Uk

How Do You Short A Stock Learn With Examples Ig Uk

How Short Selling Works Youtube

How Short Selling Works Youtube

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

/the-basics-of-shorting-stock-356327-v2-5bc4c22346e0fb0026b436d3.png)

Comments

Post a Comment